Table of Contents >> Show >> Hide

- Quick Map

- Way 1: Build a Low-Cost “Fixed-Expense Floor” (Housing & Essentials First)

- Way 2: Let the Safety Net Do Its Job (Benefits, Clinics, and Bill Help)

- Way 3: Run a Lean Budget + Boost “Invisible Income” (Tax Credits & Smart Extras)

- Conclusion: It’s Not About “Living Cheap.” It’s About Living Smart.

- Experience Notes (About ): What This Looks Like in Real Life

Living on under $20,000 a year in the U.S. can feel like trying to do a Costco haul with a convenience-store wallet.

But it’s possibleespecially if you treat money like a system instead of a mood. The big idea: you don’t “budget harder”

so much as you redesign the parts of life that silently eat cash (housing, transportation, health care), then stack every

legitimate support available (tax credits, benefits, community resources), and finally run a simple plan you can actually stick to.

One important note before we jump in: “under $20,000” could mean gross income, take-home pay, or a mix of wages plus gig work,

benefits, or irregular paychecks. Your taxes, rent market, and eligibility for programs vary by state, household size, age,

disability status, and immigration status. So think of this as a playbookthen customize it to your reality.

Way 1: Build a Low-Cost “Fixed-Expense Floor” (Housing & Essentials First)

On $20,000 a year, the math is blunt: $20,000 ÷ 12 ≈ $1,667 per month (before taxes). If your rent alone is $1,200,

you’re not “bad with money.” You’re trapped in a numbers problem. The fastest way out is to shrink fixed costs

(the bills that show up whether you’re thriving or just emotionally supporting your couch).

1) Choose the least expensive safe housing setup you can tolerate

Housing is usually the make-or-break line. If you can reduce housing costs by even $250/month, that’s $3,000 a yearreal money

at this income level. Options that commonly work:

- Roommates or shared housing: Not glamorous, but neither is choosing between rent and groceries.

- Renting a room (not a whole place): Often the cheapest way to live in higher-cost areas.

- Relocating to a lower-cost region: If job/family ties allow, a smaller city or rural area can drop rent dramatically.

- Income-based housing / vouchers: If you qualify, you may pay a portion of income rather than market rent.

If you’re applying for rental assistance, expect waiting lists in many places. Still apply anyway. Future-you will be grateful you got

your name on the list instead of waiting until a crisis forces you to speed-run paperwork while stressed.

2) Treat utilities like a negotiable expense (because they often are)

Utilities are sneaky: each one seems “not that bad,” and then suddenly you’re paying more for your house’s comfort than your own.

Try a three-step approach:

-

Lower the baseline: Weather-strip doors, use draft stoppers, swap to LED bulbs, and set a realistic thermostat range.

Small changes matter more when the budget is tight. -

Ask for help early: Many utility companies offer payment plans or hardship programs. Energy assistance programs may help with bills

or crisis shutoffs in some states. - Reduce “subscription creep”: If you have three streaming services but no emergency fund, your TV is living a richer life than you are.

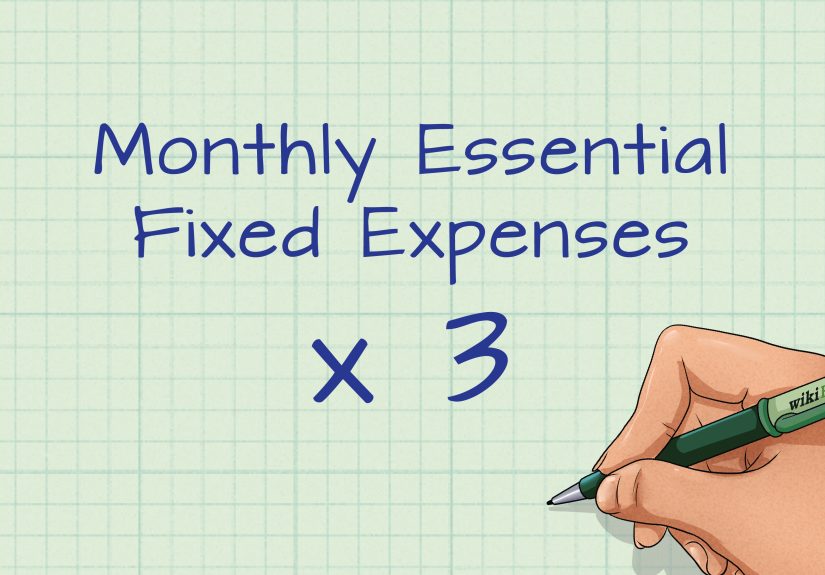

3) Build a “Minimum Viable Month” budget (simple, not perfect)

The goal is not to create a beautiful spreadsheet you never open again. The goal is to define the minimum you must cover every month

so you can stop getting ambushed.

| Category | Target (Example) | How to Make It Realistic |

|---|---|---|

| Housing + utilities | $700–$950 | Room rental, roommate share, income-based options, energy assistance, lower usage |

| Food | $200–$350 | Cook basics, buy store brands, use food pantries if needed, enroll in eligible nutrition programs |

| Transportation | $80–$250 | Public transit pass, biking/walking, carpooling, keep car only if it’s truly required for work |

| Phone + internet | $30–$80 | Low-cost carrier plans, discounts for eligible households, avoid device payment traps |

| Health costs | $0–$100 | Medicaid/Marketplace options, community health centers, generic meds, preventive care |

| Buffer | $50–$150 | Sinking fund for irregular expenses (laundry, toiletries, small emergencies) |

If your numbers don’t fit at first, that’s not failureit’s information. It tells you which fixed cost needs a structural change

(usually housing or transportation), not a “skip coffee” lecture.

Way 2: Let the Safety Net Do Its Job (Benefits, Clinics, and Bill Help)

A lot of people avoid benefits because they feel complicated or stigmatized. But if you’re eligible, these programs exist for exactly this situation:

helping you cover basics so one surprise doesn’t become a catastrophe. Think of it like wearing a seatbelt. You’re not “planning to crash.”

You’re refusing to let one bad day ruin your year.

1) Start with food and health coverage (the two biggest stabilizers)

-

Food help: Nutrition assistance programs can lower grocery costs so you can pay rent on time. Eligibility rules vary,

but many states use income and household size to determine benefits. -

Health coverage: If your state has expanded Medicaid, many low-income adults may qualify. If not, Marketplace plans can still be an option,

and premium tax credits may reduce monthly costs depending on income and household size.

If you’re uninsured, don’t wait for an emergency. Preventive care and basic treatment are usually far cheaper than crisis care.

Community health centers often provide care on a sliding fee scale based on income.

2) Apply for “bill reducers” that shrink monthly pressure

These supports don’t just “help a little.” They can change your whole budget structure:

- Energy assistance: Programs in many states help with heating/cooling costs, crisis shutoffs, and sometimes weatherization.

- Phone/internet discounts: Some programs help lower the monthly cost of staying connected for work, school, and health care.

- WIC (if eligible): For pregnant people, postpartum, infants, and young children, WIC can provide specific nutritious foods and support.

3) Use local resource networks like it’s your part-time job (because it kind of is)

When money is tight, information becomes currency. One of the easiest “next steps” is dialing 2-1-1 (in many areas) or using local resource directories

to find help with:

- Food pantries and community meals

- Rental assistance, shelters, and housing counseling

- Utility assistance and weatherization programs

- Low-cost medical/dental clinics

- Job training, resume help, and childcare resources

Pro tip: keep a simple “benefits folder” (paper or phone notes) with ID, proof of address, pay stubs, award letters, and key logins.

It turns chaotic applications into a repeatable process.

4) Don’t miss protections you already qualify for

Depending on your situation, you might qualify for reduced fees, hardship plans, or deferred payments through hospitals, utility companies, or nonprofits.

Ask early and politely. The magic phrase is: “Do you have a hardship program, sliding scale, or payment plan?”

It’s not awkward; it’s responsible.

Way 3: Run a Lean Budget + Boost “Invisible Income” (Tax Credits & Smart Extras)

On a low income, you can’t “optimize” your way out of every problembut you can stop leaking money and capture the support you’ve earned.

This is where boring wins. Boring is beautiful. Boring keeps the lights on.

1) Use a budget method that works when life is messy

Traditional budget rules are fine, but on under $20,000, “wants” may be mostly “please let me feel human.” Try a two-layer approach:

- Layer A (non-negotiables): Housing, utilities, basic food, transportation to work, essential meds.

- Layer B (flex): Everything elseclothes, gifts, eating out, subscriptions, random “How did I spend $27?” moments.

Then run a simple weekly check-in: every Sunday, look at your balance and upcoming bills and decide what this week can afford. No guilt. Just math.

2) Claim the tax credits you’re eligible for (this is real money)

If you work and your income is low to moderate, the Earned Income Tax Credit (EITC) may provide a refund even if you owe little or no federal income tax.

The maximum EITC amount depends on how many qualifying children you have, and it changes year to year.

For example, for tax year 2025, maximum credits range from hundreds (no qualifying children) to several thousand dollars (with qualifying children).

If you’ve never received a large refund, don’t treat it like a shopping spree. Treat it like a stability tool:

- Pay off a high-cost debt (if you have it)

- Build a small emergency fund (even $300–$600 is powerful)

- Prepay a month of rent or utilities if that reduces stress

- Fix the thing that keeps breaking (the cheapest repair is the one you only do once)

To keep filing costs at zero, look for legitimate free filing options and free community tax help if you qualify.

Paying a chunk of your refund in preparation fees is like tipping the waiter with your rent money. Let’s not.

3) Add “small, steady” income without breaking benefits or burnout

When you’re under $20,000, extra income helpsbut it must be realistic. The best side income is:

legal, low-cost to start, and predictable enough to plan around.

- Skill-based micro work: babysitting, tutoring, pet sitting, basic yard work, housekeeping, simple tech help.

- Sell what you already own: declutter and sell items locally (safely, in public places).

- Seasonal hours: holiday retail, event staffing, tax-season admin work.

Important: if you receive means-tested benefits, report income as required and learn the rules so you don’t get hit with overpayments.

The goal is stability, not a paperwork boomerang.

4) Remove the “poverty fees” where you can

Low-income households often get charged extra for being low-incomeoverdraft fees, late fees, pay-by-the-week markups, and high-interest financing.

A few moves that can help:

- Set alerts for low balance and upcoming bills

- Use a no-fee bank account if possible

- Pay rent/utilities a few days early if you tend to forget (future-you will high-five you)

- Choose used items for big needs (furniture, kitchen basics) instead of financing new

This isn’t about perfection. It’s about reducing the number of times you have to pay money for the crime of not having money.

Conclusion: It’s Not About “Living Cheap.” It’s About Living Smart.

Living on under $20,000 a year requires strategy, not shame. Build a low-cost fixed-expense floor (especially housing),

use benefits and community resources to stabilize food and health care, then run a lean budget that captures tax credits and avoids “poverty fees.”

The goal isn’t to become a spreadsheet superheroit’s to make life predictable enough that you can breathe, plan, and gradually build options.

If you only do one thing this week, do this: pick the single biggest expense you can change (often housing or transportation),

and take one concrete stepapply, call, compare, or negotiate. Big outcomes often start with annoyingly small actions.

Experience Notes (About ): What This Looks Like in Real Life

The stories below are fictionalized but realisticbuilt from common patterns people report when living on a very low income.

Think of them like “budget field notes”: not perfect, not magical, but practical.

Experience 1: The Room-Rental Reset

“Jordan” earns about $19,200 a year working a steady part-time job plus occasional extra shifts. The first budget attempt failed immediatelybecause rent

was eating nearly everything. The breakthrough wasn’t a fancy budgeting app; it was switching from a solo apartment to renting a room in a shared house.

That one decision dropped monthly housing costs by a few hundred dollars, which finally created breathing room for food, transit, and a small buffer.

Jordan then did two “boring” moves that had outsized impact: (1) set bill due-date reminders and (2) canceled two subscriptions that were basically

emotional support services. The funny part? Jordan didn’t miss them much. Once rent stopped being a weekly panic, the need for “tiny escapes” got smaller.

The lesson: sometimes the best mental-health purchase is affordable housing.

Experience 2: The Single-Parent Stack

“Renee” has one child and works hourly shifts that change week to week. The biggest problem wasn’t just low incomeit was instability.

Renee created a “minimum viable month” plan: rent, utilities, basic groceries, and childcare came first. Then Renee leaned on supports that reduced

recurring costs, including nutrition and health coverage options, and used local resource referrals to find periodic help with utilities.

The real game-changer was tax time. Renee stopped paying high fees to file and used free help instead. The refund (helped by eligible credits)

didn’t become a shopping spreeit became a stability tool: a small emergency fund, a paid-down bill, and a pre-paid car repair fund.

Renee called it “buying fewer bad days,” which is both accurate and unintentionally poetic.

Experience 3: The Car-Free Upgrade (Yes, Really)

“Sam” lives in a city with decent transit. Sam’s car was supposed to mean freedom, but it kept turning into surprise bills: repairs, insurance,

registration, and the occasional “Why is gas the price of perfume?” moment. After a scary repair estimate, Sam tried a 60-day experiment:

transit pass + biking + occasional rides from friends for longer trips. The result wasn’t glamorous, but the budget finally worked.

Without car costs, Sam could handle rent on time and afford consistent groceries. The best part: stress dropped. Sam described the change as

“trading a car payment for sleep,” which is an underrated life upgrade. The lesson: if your area allows it, reducing transportation costs can be

as powerful as a raisesometimes more, because it also reduces financial surprises.

Across these experiences, the pattern is the same: fix the biggest repeating cost, stack legitimate supports, then keep the plan simple enough to repeat.

On under $20,000, consistency beats intensity. You don’t need a perfect monthyou need a survivable one, repeated.