Table of Contents >> Show >> Hide

- What “Importer of Record” Really Means (Not the Marketing Version)

- Core IOR Responsibilities (The Stuff You Can’t Contract Away)

- What an Importer of Record Provision Should Include (Contract Anatomy)

- A) Identify the IOR (clearly, consistently, and without drama)

- B) Define scope of services if using an IOR service provider

- C) Responsibilities matrix (who does what)

- D) Data accuracy warranties (the quiet hero clause)

- E) Payment terms for duties, taxes, and disbursements

- F) Compliance “hot zones” (spell these out)

- G) Audit, inquiries, and post-entry corrections

- H) Indemnity and limitation of liability (where the arguments usually live)

- Common Scenarios (With Specific Examples)

- Practical Checklist: “If We Sign This, Can We Actually Import?”

- Field Notes: 6 Real-World “IOR Provision” Experiences (Composite Examples)

- 1) “We outsourced customs, so we’re covered”… until the audit letter arrives

- 2) The invoice description that launched a thousand follow-up questions

- 3) The “minor” bill-of-materials change that wasn’t minor to customs

- 4) Duties paid by the provider… and reconciled by chaos

- 5) The bond that was too small for success

- 6) ISF responsibility confusion (a.k.a. the “ocean shipment surprise”)

- Conclusion

“Importer of Record provision” sounds like the kind of phrase that shows up in a contract right before everyone’s eyes glaze over.

But if you import anything into the United Statesmachines, cosmetics, electronics, apparel, replacement parts, even “just samples”this

little provision can decide who pays duties, who gets audited, who gets penalized, and who gets to enjoy the special thrill of a CBP hold

at 4:58 p.m. on a Friday.

This article breaks down what an Importer of Record (IOR) is under U.S. customs rules, what responsibilities attach to that role, and how

to write (or review) an import-of-record provision so it actually protects your business instead of becoming an expensive word cloud.

What “Importer of Record” Really Means (Not the Marketing Version)

In U.S. customs practice, the Importer of Record is the party responsible for making entry of merchandise and ensuring compliance

with applicable laws and regulations. In plain English: the IOR is the name on the paperwork when the government asks,

“Okay… who’s accountable for this shipment?”

The IOR is typically the U.S. buyer, owner, or consignee of the goods, but other eligible parties can sometimes act as IOR depending on the structure

of the transaction and the documentation. This is why contracts often include an Importer of Record provisionto spell out exactly

who will serve as IOR and what each side must do to support compliant importation.

Why an IOR provision matters

- Money: Duties, taxes, fees, broker charges, and “surprise” costs like storage or exams.

- Risk: Penalties for incorrect data, misclassification, undervaluation, or missing filings.

- Control: Who decides HS/HTS classification, country of origin, and whether to claim free trade benefits.

- Proof: Recordkeeping and audit supportbecause CBP can ask questions long after the goods are sold.

Core IOR Responsibilities (The Stuff You Can’t Contract Away)

A well-written Importer of Record provision allocates tasks between parties, but it cannot magically erase legal responsibility.

If your company is listed as IOR, you’re expected to exercise reasonable care over entry data, classification, valuation,

and supporting documentationeven if a broker or service provider does the filing.

1) Entry and entry summary obligations

U.S. import clearance generally involves “entry” (getting the goods released) and the entry summary (finalizing the financial and

compliance details). The entry summary includes key data like classification, value, duties, and importer identification.

Many contracts reference “customs clearance,” but your IOR provision should be specific: who provides the data, who files, and who pays.

2) Correct classification (HTS) and product descriptions

Classification is not a vibes-based activity. The Harmonized Tariff Schedule (HTS) number drives duty rates, admissibility requirements,

and whether other rules apply (like special tariffs or partner government agency requirements).

Your provision should clarify:

- Who determines the HTS code (and whether the other party can dispute it).

- What product detail must be provided (materials, function, model, technical specs).

- Who supplies supporting documentation (tech sheets, composition breakdowns, rulings, lab reports).

3) Valuation and duty payment

CBP expects accurate declared value based on the applicable valuation method (often transaction value, but not always).

If the commercial invoice is incomplete, inconsistent, or missing key elements, delays and enforcement risk go up fast.

Your Importer of Record provision should address:

- Who issues the commercial invoice and what must be included (pricing, currency, terms, assists, royalties, etc.).

- Who pays duties/taxes/feesand how reimbursements work if one party advances them.

- How you handle post-entry corrections or additional duties discovered later.

4) Import bonds (continuous vs single transaction)

Most commercial imports require a customs bond to secure compliance and payment obligations. Contracts often say

“Seller will act as IOR,” but forget the bondthen the shipment shows up and everyone learns what “operational reality” means.

An IOR provision should specify:

- Who provides the bond (IOR typically does).

- Whether it’s continuous or single-transaction, and minimum bond amounts or review triggers.

- Who pays bond premiums and what happens if the bond is insufficient or called upon.

5) Recordkeeping and audit support

U.S. importers have recordkeeping obligations for import-related records and must be able to produce them upon request.

This is where “We’ll figure it out later” becomes “We can’t find the invoice from four years ago.”

Your provision should require:

- Document retention timelines and formats (digital storage is fine if controlled and retrievable).

- Shared access to core records: invoices, packing lists, bills of lading, origin support, classification support, broker filings.

- Cooperation in audits, requests for information, and post-entry actions.

6) Security filings (ISF “10+2” for ocean imports)

If cargo arrives by vessel, the Importer Security Filing (ISF) requirements can apply. Many businesses assume “the forwarder does that.”

Sometimes they dobut the contract should clarify responsibility, authorization, and who eats penalties if it’s late or wrong.

What an Importer of Record Provision Should Include (Contract Anatomy)

Think of the IOR provision as a checklist disguised as legal language. If it doesn’t answer the questions below, it’s not a provision

it’s an optimistic haiku.

A) Identify the IOR (clearly, consistently, and without drama)

- Legal name of the IOR entity and address.

- Who is the importer shown on entry documentation and entry summary.

- Whether the IOR role applies to all shipments or only specific products/lanes.

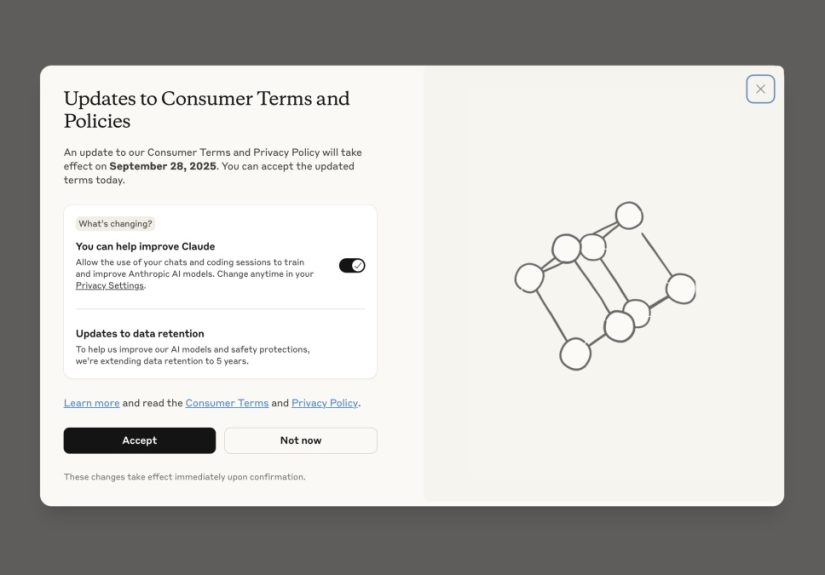

B) Define scope of services if using an IOR service provider

If a third party provides IOR services (common in cross-border B2B, tech deployments, or foreign sellers without a U.S. presence),

the provision should separate filing services from legal responsibility.

- Who will act as customs broker of record (or who appoints the broker).

- Power of attorney requirements and limits.

- Data submission deadlines and “no data, no ship” rules.

C) Responsibilities matrix (who does what)

The easiest way to prevent disputes is to spell out responsibilities like a relay race: who holds the baton at each step.

- Seller/shipper: accurate invoice, product details, packing info, origin/manufacturing data, required certificates.

- Buyer/IOR: classification decisions (or approval), bond, duty payment method, broker instructions, record retention.

- Broker/provider: filing, transmission, entry summary prep, status updates, exception handling.

D) Data accuracy warranties (the quiet hero clause)

Many penalties and delays start with bad data: wrong product description, missing manufacturer ID, inconsistent quantities, incorrect value,

or a country of origin that changes midstream. The IOR provision should include:

- Warranty that provided data is true, correct, and complete.

- Obligation to notify of changes (new supplier, new bill of materials, updated product specs).

- Right to suspend shipments if data is missing or inconsistent.

E) Payment terms for duties, taxes, and disbursements

Decide whether duties are paid:

- Directly by the IOR using its own ACH account, or

- Advanced by a broker/provider and billed back with a fee.

Then define reimbursement timing, disputes, and what happens if a shipment is held and storage costs accrue.

F) Compliance “hot zones” (spell these out)

Your IOR provision should address common trigger areas:

- Partner Government Agencies: FDA, EPA, USDA, FCCdepending on product type.

- Trade remedies: antidumping/countervailing duties (AD/CVD) and special tariff measures where applicable.

- Marking and labeling: country-of-origin marking, required warnings, and product-specific labeling rules.

- Restricted/controlled items: anything regulated, dual-use, or requiring permits (be explicit about exclusions).

G) Audit, inquiries, and post-entry corrections

CBP questions can arrive after import. Your provision should require:

- Cooperation in responding to CBP requests for information.

- Who controls responses (IOR should retain final authority).

- How post-entry corrections, protests, or disclosures are handled and funded.

H) Indemnity and limitation of liability (where the arguments usually live)

This is the part where everyone suddenly becomes very interested in punctuation. A fair approach is to tie liability to control:

- If the seller provides wrong invoice/value/origin data, seller indemnifies.

- If the IOR insists on a classification strategy, IOR owns that decision.

- If a broker/provider makes an unapproved change or files late, the provider covers resulting penalties (subject to negotiated caps).

Important: caps and exclusions must be realistic. If the contract caps liability at “fees paid in the last 30 days,” but penalties can be much larger,

you’re basically buying an umbrella made of paper towels.

Common Scenarios (With Specific Examples)

Scenario 1: Foreign seller ships DDP and “handles customs”

A non-U.S. seller offers Delivered Duty Paid (DDP) terms and says it will “be the importer.” The contract should confirm:

who is listed as IOR, who posts the bond, who chooses HTS codes, and how the buyer will get import records for audits or resale compliance.

If the buyer’s name appears as IOR despite the seller’s promise, the buyer may still carry the compliance risk.

Scenario 2: U.S. buyer is IOR but relies on supplier’s paperwork

A U.S. company imports components from multiple overseas factories. The supplier prepares invoices and packing lists. The IOR provision (or supplier agreement)

should require consistent item descriptions, correct manufacturer identity data, and prompt notice of any material changes (like switching factories or materials).

Scenario 3: IOR service provider for project-based imports

A tech company needs equipment imported temporarily for deployments, demos, or repairs. An IOR service provider may file entries and coordinate brokers.

The provision should state whether the import is permanent or temporary, how returns are documented, and who keeps records to prove the outcome.

Practical Checklist: “If We Sign This, Can We Actually Import?”

- Do we know exactly who the IOR is on the entry summary?

- Do we have a bond strategy (continuous vs single-transaction)?

- Do we control classification and valuation decisionsor at least approve them?

- Do we have a data package requirement (specs, invoices, origin support, certificates)?

- Is there a plan for ISF (if ocean) and other agency requirements (if applicable)?

- Do we have record access for five years and a process to retrieve documents quickly?

- Does indemnity match the party responsible for the underlying data/decisions?

Field Notes: 6 Real-World “IOR Provision” Experiences (Composite Examples)

The stories below are composite scenarios drawn from common import compliance patternsmeaning they’re not about one specific company,

but they are painfully recognizable if you’ve ever had to explain a delayed container to leadership.

1) “We outsourced customs, so we’re covered”… until the audit letter arrives

A company hired a broker and assumed the broker “owned compliance.” When CBP requested supporting records years later, the importer

discovered the broker only retained a limited set of documents. The fix wasn’t magicalit was contractual: the IOR provision was updated to

require shared archiving (invoices, classification support, origin substantiation) and to define retrieval SLAs for audits.

Lesson: brokers file; importers prove.

2) The invoice description that launched a thousand follow-up questions

A shipment cleared for months with an invoice description like “parts” (which is about as useful as labeling your lunch “food”).

A later review triggered holds because the description didn’t match the product’s actual function, and classification became uncertain.

The updated IOR provision required minimum description standards: material, function, model, and end use where needed.

Lesson: better descriptions cost pennies and save weeks.

3) The “minor” bill-of-materials change that wasn’t minor to customs

A supplier changed a component material to address a shortage. Nobody updated the classification support, and the HTS number used at entry

became questionable. The importer had to spend time correcting prior entries and rebuilding documentation. The contract solution:

a change-notification clause requiring suppliers to alert the importer before material or manufacturing changes, with updated spec sheets included.

Lesson: supply chain changes are compliance changes.

4) Duties paid by the provider… and reconciled by chaos

A service provider advanced duties and billed the importer. The invoices didn’t tie cleanly to entry numbers, and finance couldn’t reconcile

charges across shipments. The revised provision required: entry number reference on every duty advance, breakdown by duty/fee type, and a weekly

statement for open items. Lesson: if money moves, documentation must move with it.

5) The bond that was too small for success

Imports grew quickly, but the continuous bond amount stayed the same. Entries began triggering bond insufficiency issues, creating clearance friction.

The new IOR provision added a bond-review trigger: quarterly or when import volume/duty spend increases by a defined percentage.

Lesson: scaling is greatunless your bond is stuck in last year.

6) ISF responsibility confusion (a.k.a. the “ocean shipment surprise”)

Ocean shipments were moving under the assumption that “someone” was filing ISF. One late filing later, the importer learned that “someone”

wasn’t a legally recognized entity. The contract update clarified: who files ISF, when data must be submitted, and what happens if required elements

(like manufacturer and stuffing location data) aren’t provided in time. Lesson: put a name on the responsibility, not a hope.

Conclusion

A solid Importer of Record provision does two things at once: it respects the legal reality that the IOR is accountable for import compliance,

and it builds a practical workflow so the IOR can actually meet that responsibility without guessing, chasing paperwork, or funding surprises.

The best provision is not the longestit’s the clearest: who is IOR, who provides what data, who files what, who pays what, who keeps records,

and who owns the risk when things go wrong.