Table of Contents >> Show >> Hide

- Why We Love Rules of Thumb in Investing

- Classic Investing Rules That Mostly Work

- When the Rules Break: Market-Level Exceptions

- A Framework for Knowing When You’re the Exception

- Common Mistakes When Chasing Exceptions

- Bringing It Back to Common Sense

- Real-Life Experiences: Living Through the Exceptions

- Wrapping Up: Practical Common Sense for Real Investors

If you spend any time around investing blogs, you’ll notice something funny: the same rules of thumb show up everywhere. “Don’t try to time the market.” “Diversify.” “Stick to your plan.” Many of these maxims are fantastic. They keep regular investors from blowing up their portfolios on a Tuesday afternoon because of a scary headline.

But here’s the catch: no rule works all the time, for every person, in every market. There are always exceptions to the rule. Understanding when you’re looking at a true exceptionand when you’re just looking for an excuseis one of the most important skills in common-sense investing.

In this article, we’ll walk through the classic investing rules that mostly work, the situations where they break down, and a practical framework for telling the difference. Think of it as “Common Sense Investing: Advanced Mode,” but still explained in plain English.

Why We Love Rules of Thumb in Investing

Investing is messy. Markets are noisy, data is overwhelming, and the future is stubbornly unpredictable. Our brains don’t love that. So we reach for simple shortcuts like:

- “Never try to time the market.”

- “Always stay diversified.”

- “Just buy and hold the index.”

- “Rebalance once a year.”

Psychologists call these shortcuts heuristics. They’re mental rules of thumb that let us make fast decisions without running a full spreadsheet every time. In finance, heuristics are often helpful because they protect us from emotional choicespanic-selling during a crash or piling into whatever stock is trending on social media this week.

The problem isn’t that rules of thumb exist. The problem is when we treat them as iron laws of the universe instead of flexible guidelines that sometimes have exceptions.

Classic Investing Rules That Mostly Work

Rule #1: Don’t Try to Time the Market

“Don’t time the market; it’s time in the market that matters.” If investing had a bumper sticker, this would be it. Official investor education from regulators and large asset managers repeats this theme for a reason: missing just a handful of the best market days can dramatically reduce long-term returns, and those “best days” often arrive right next to the worst ones.

For most peopleespecially busy, long-term investorstrying to jump in and out of the market based on vibes, headlines, or social media is a losing game. That’s why strategies like dollar-cost averaging (investing a set amount on a regular schedule) are so widely recommended. They remove the pressure to pick “the perfect day” and keep you investing through both up and down markets.

The exception: When a lump sum and a solid plan beat drip-feeding

If you suddenly receive a large amount of money (from a bonus, inheritance, or business sale), the standard advice is to spread it out over time to reduce regret if markets drop right after you invest. But statistically, investing a lump sum immediately has historically outperformed dollar-cost averaging more than half the time because markets tend to rise over long periods.

So here’s the nuance: for highly disciplined investors with a strong risk tolerance, investing a lump sum into a well-diversified portfolio can be a rational “exception to the rule.” For everyone else, the emotional comfort of phasing in slowly may be worth the small expected performance trade-off.

Rule #2: Diversify, Diversify, Diversify

Diversification is investing’s version of “don’t put all your eggs in one basket.” By spreading your money across many companies, sectors, and even countries, you reduce the risk that one mistake wipes you out. Big firms and regulators promote diversification because, frankly, most people have no business betting their life savings on just a couple of stocks.

Broad index funds, target-date funds, and simple stock-bond mixes exist largely to make diversification easy and cheap. For the vast majority of investors, this rule should never be ignored.

The exception: Productive concentration (with huge asterisks)

There are people who got rich by not diversifying: founders whose company stock went to the moon, early employees at tech giants, legendary investors who concentrated in a handful of ideas. But for every well-known success story, there are countless quiet failures we never hear about.

Concentrated positions might make sense when:

- You have specialized knowledge in a specific business or industry.

- You can afford to lose a large part of that concentrated bet without derailing your life.

- You also hold a diversified “sleep at night” portfolio in the background.

In other words, concentrated investing might be an exception for people with exceptional resources, knowledge, and capacity for risknot a template for everyone with a hot stock tip.

Rule #3: Stick to Your Long-Term Plan

Another common rule: pick a reasonable asset allocation (for example, 60% stocks and 40% bonds), then stick with it through thick and thin. This rule exists to keep you from constantly tinkering with your portfolio based on short-term market noise.

Evidence suggests that investors who stick to a long-term, diversified plan often do better than those who trade frequently or abandon their strategy during scary moments. Discipline matters.

The exception: When your life changes faster than your plan

Sometimes the right move is not to stick with the old plan. You might need to change your strategy when:

- Your income or job security changes significantly (layoff, big promotion, career switch).

- Your time horizon shrinks (you’re closer to retirement, college costs, or buying a home).

- Your risk tolerance changes after living through major volatility.

Here, “stick to the plan” becomes harmful if the plan itself is outdated. The rule still helps (you don’t want to make emotional, mid-crash decisions), but it must be anchored to a plan that matches your current reality.

When the Rules Break: Market-Level Exceptions

Rules of thumb are usually built on long-term averagesbut markets don’t read the script. Historical patterns can flip for years at a time. That’s when faithful rule-followers start wondering if the rules are broken.

Exception #1: When diversification seems to “stop working”

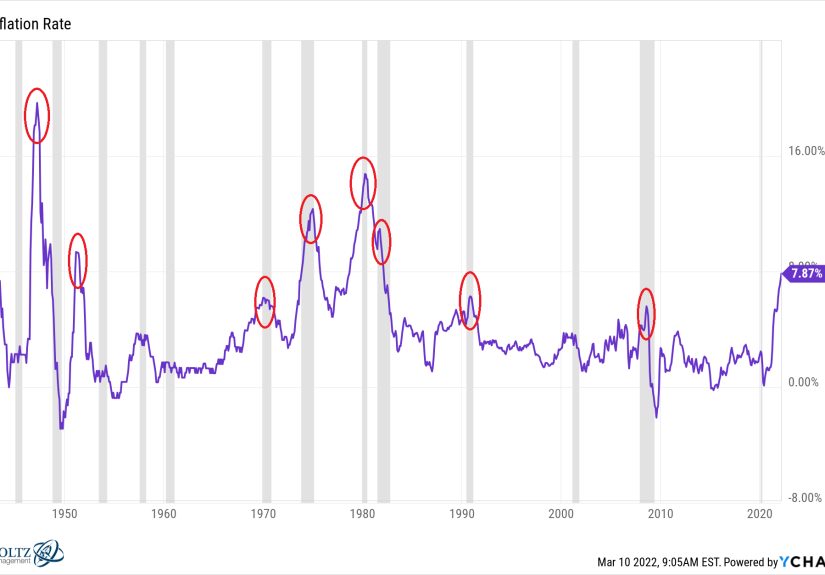

A classic example is when stocks and bonds, which usually move in opposite directions, both fall at the same time. In some periods, rising interest rates or inflation hit both asset classes, leaving diversified investors feeling like nothing is working.

Does that mean diversification is dead? Almost always, no. It means that the specific mix of risks markets are dealing with is hurting many assets at once. Over the long term, owning different types of investments still tends to soften the blow compared with an all-or-nothing bet on one asset.

Exception #2: When rules become so popular they create new risks

Rules aren’t just something individual investors follow. Many large institutions rebalance portfolios at regular times, follow 60/40 stock-bond splits, and use mechanical trading rules. When trillions of dollars move based on the same calendar-driven rule, that predictability can be exploited by more nimble traders.

Recent research has shown that highly predictable rebalancing flows can briefly push prices around, creating extra trading costs for rule-followers. That doesn’t mean rebalancing is badbut it does mean that blindly following a rigid schedule without considering costs might be less than optimal in some environments.

Exception #3: When new tools or markets change what’s “normal”

Rules often emerge from the environment in which they were born. For example, “avoid high fees” became a core principle because expensive, actively managed funds historically underperformed cheap index funds after costs. Today, the investing landscape includes low-cost index ETFs, factor funds, and a huge range of niche products.

The core ideacontrol your costsis still rock solid. But the specific products that best implement that rule may change as markets evolve and innovation lowers fees or opens new options.

A Framework for Knowing When You’re the Exception

So how do you tell whether you’re wisely recognizing an exception or just telling yourself a comforting story before doing something reckless?

Step 1: Ask, “Who was this rule built for?”

Most rules of thumb are designed for the average investor: limited time, limited expertise, emotionally reactive, and tempted by market noise. If that describes you (and it describes most of us), you should assume the rule applies unless you have a very strong, objective reason to think otherwise.

Step 2: Separate math from emotions

Write down your actual reasoning. If your explanation includes phrases like “I just have a feeling,” “everyone is saying,” or “I’m tired of waiting,” you’re probably not seeing a genuine exceptionyou’re negotiating with your emotions.

On the other hand, if you can clearly lay out:

- Your time horizon and cash needs.

- Your risk tolerance and what loss you can actually stomach.

- How this decision fits into a broader plan, not just this week’s news.

then you’re at least having an adult conversation with yourself.

Step 3: Consider what happens if you’re wrong

Every exception should come with a “failure scenario.” If your assumption fails, do you experience embarrassment, or financial ruin? Does this decision risk your retirement, your home, or your ability to cover basic bills?

Exceptions should rarely put your core financial life at risk. If they do, you’re not making a clever exceptionyou’re gambling.

Step 4: Make exceptions smaller and slower

One of the best ways to be smart about exceptions is simply to make them smaller.

- Curious about a concentrated stock idea? Make it a small percentage of your overall portfolio.

- Thinking about changing your asset allocation? Adjust it gradually instead of all at once.

- Want to try a new rebalancing or timing strategy? Test it with a small portion of your money first.

This “small exceptions” rule lets you explore ideas without betting the farm on your own brilliance.

Common Mistakes When Chasing Exceptions

Even smart investors fall into traps when they go hunting for exceptions to the rule. Here are a few of the biggest:

Hindsight bias

After the fact, every exception looks obvious. “Of course that bubble was going to burst.” “Of course that stock was going to dominate.” But investors in real time don’t have the benefit of hindsight. Be wary of narratives that make risk-taking look inevitable and painless.

Survivorship bias

We hear a lot about the people who broke the rules and got rich. The people who broke the rules and quietly lost everything rarely get podcast invitations. When you’re deciding whether to copy a bold “exception,” remember the invisible graveyard of failed attempts.

Overconfidence in your own story

Humans are great storytellers. We can rationalize almost anything. The more emotionally attached you are to a particular outcome“this stock has to go up,” “this time really is different”the more likely you are to convince yourself that you’re seeing a legitimate exception when you’re not.

Bringing It Back to Common Sense

The heart of common-sense investing isn’t about memorizing every rule. It’s about understanding why rules exist, where they help, and where they can quietly hurt if followed blindly.

Most investors will be well served by a simple approach: define clear goals, invest regularly, diversify widely, keep costs low, and stay invested for the long term. Within that structure, exceptions are like seasoning: a pinch can enhance the dish, but too much ruins it.

When in doubt, assume you’re the rulenot the exception. And if you’re sure you’re the exception, make sure the consequences of being wrong are something you can actually live with.

Real-Life Experiences: Living Through the Exceptions

It’s one thing to talk about rules and exceptions in theory. It’s another to live through them with real money on the line. Let’s look at a few composite “stories” based on common real-world experiences many investors have had.

The tech employee with too much of a good thing

Imagine a software engineer at a fast-growing tech company. Over a decade, they’ve accumulated a mountain of company stock through options and restricted shares. The company has done incredibly well, and now this single stock represents 70% of their net worth.

The rule says: “Diversify.” The exception whispers: “But my company is different.” It feels wrong to sell even a little, especially when colleagues brag about being “all in.”

Then a rough year hits the tech sector. The stock drops 50%. Our engineer is still employed, but their future feels a lot shakier. At this point, they finally diversifyselling some company stock, building a broad index-fund portfolio, and shifting toward a more balanced plan.

Did they break the rule? For years, yes. But the experience teaches a hard lesson: it’s easier to diversify before you’re forced to. A more common-sense approach would have treated concentration as a temporary, carefully managed exception, not a permanent identity.

The retiree who learned that “safe” is relative

Now picture a new retiree who internalized another rule: “As you age, shift more to ‘safe’ bonds.” They faithfully moved a large portion of their portfolio into longer-term bonds right before interest rates rose sharply.

Suddenly, those supposedly safe bonds dropped in value at the same time inflation was rising. It felt like the exception to the comforting story that bonds always provide stability when stocks wobble.

After talking with an advisor, the retiree adjusted course. They diversified across different types of bonds, added some high-quality dividend stocks, and kept a cash buffer for near-term spending. The lesson wasn’t that the rule was wrongit was that “safety” depends on the environment, time horizon, and how all the pieces fit together.

The young investor who “broke” the timing rule the right way

Finally, consider a young investor who receives a large bonus. They’ve heard “don’t try to time the market,” but also read that lump-sum investing often beats dollar-cost averaging over long periods. Instead of agonizing for months over the perfect entry point, they decide on a simple, common-sense compromise.

They invest half of the bonus immediately into a diversified portfolio, then spread the remaining half over the next 6–12 months. This approach acknowledges the data favoring lump-sum investing while respecting their emotional comfort with gradual entry.

Did they technically “time” the market? Not really. They used an evidence-based rule (stay invested) and made a small, structured exception that fit their personality and risk tolerance. The key wasn’t predicting short-term market movesit was choosing a process they could actually stick with.

What these experiences have in common

Across these stories, a pattern emerges:

- Rules of thumb provided a helpful starting point.

- Exceptions showed up when life, markets, or risks didn’t quite match the textbook scenario.

- The best outcomes came when people recognized exceptions early, sized their bets modestly, and kept a solid long-term plan at the core.

That’s really what “exceptions to the rule” should mean in investing: not a license to ignore common sense, but a reminder that real life is messy, and good rules are flexible guides, not handcuffs.

Wrapping Up: Practical Common Sense for Real Investors

Investing wisdom often sounds like a list of commandments. In reality, it’s more like a set of road signs. “Slow down here.” “Watch for curves.” “Bridge may be icy.” Ignore the signs entirely and you’ll probably crash. Obey them blindly without noticing the actual road, and you can still get into trouble.

The sweet spot is where rules of thumb and real-world judgment meet. Use the rules to avoid big, obvious mistakes. Use judgmentand a healthy respect for uncertaintywhen you suspect you might genuinely be the exception.

If you remember nothing else, remember this: it’s better to be roughly right with a boring, diversified plan than precisely wrong with a heroic bet you can’t afford to lose.

SEO Metadata & Summary

sapo: Investing advice is full of bold rules: don’t time the market, always diversify, stick to your plan. They’re popular because they usually workand they protect everyday investors from emotional, last-minute decisions that can wreck a portfolio. But no rule is perfect. Markets change, life happens, and sometimes being too rigid can quietly introduce new risks. This in-depth guide unpacks where the most famous rules of thumb come from, when exceptions make sense, how to spot the difference between smart nuance and dangerous overconfidence, and how to build a practical, common-sense strategy you can live with through every market cycle.