Table of Contents >> Show >> Hide

- The “typical” down payment right now (and why your mileage will vary)

- Minimum down payments by loan type

- Why 20% down is famous (and when it’s worth chasing)

- How to choose a down payment: a practical framework

- Loan-program reality check: what the minimum does (and doesn’t) mean

- Down payment assistance: help exists, but it comes with rules

- How much should you put down? Common scenarios with specific examples

- Saving for a down payment without hating your life

- Real-World Down Payment Experiences : What People Learn After the Paperwork

- Conclusion: Pick a down payment you can live with (and still afford life)

If you’ve heard you “need 20% down” to buy a home, congratulations: you’ve met one of the most stubborn myths in personal finance.

It’s like Bigfootlots of sightings, not always required.

In reality, the down payment you need depends on your loan type, your credit profile, the home price, and how much monthly payment (and risk) you can comfortably carry.

Some buyers put down 20% (or more). Many don’t. And a few qualified buyers can put down 0%.

This guide breaks down what down payments typically look like in the U.S., the minimums by loan type, what you gain (and give up) by putting more down, and how to choose a number that fits your budgetwithout turning your savings account into a sad, empty echo chamber.

The “typical” down payment right now (and why your mileage will vary)

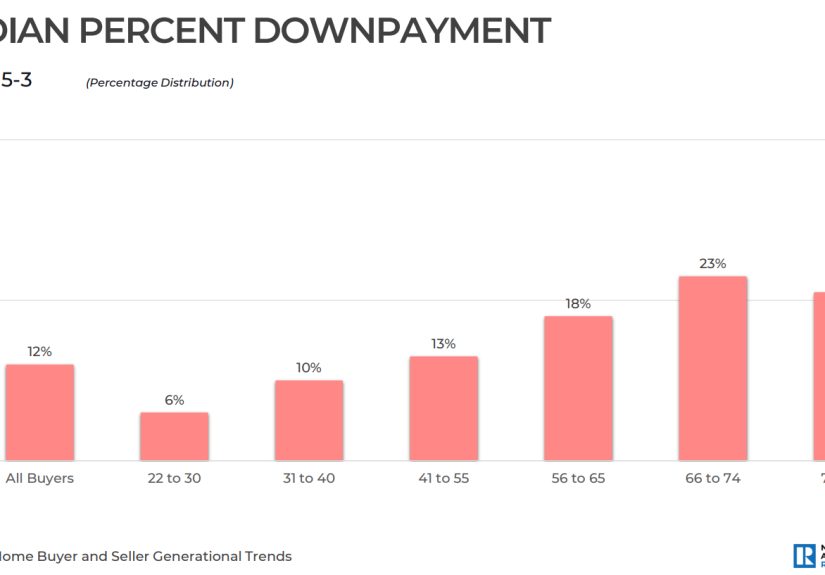

Let’s separate minimum required from commonly paid. National survey data shows buyers often put down more than the minimum.

In the NAR’s 2025 Profile of Home Buyers and Sellers, the median down payment was 19% overall, 10% for first-time buyers, and 23% for repeat buyers.

(Those numbers reflect owner-occupant buyers and can shift with home prices, rates, and market conditions.)

Translation: plenty of people are buying with 3%–10% down, but many who can afford to put more down do itoften to lower the monthly payment, compete in a tight market, or reduce mortgage insurance costs.

Minimum down payments by loan type

Here are common minimum down payment rules you’ll see in the U.S. market. Your lender may have stricter requirements (called “overlays”), and certain properties (condos, multi-unit, second homes) may require more.

Conventional loans (often 3%–5% minimum)

- As low as 3% down is possible on certain conforming conventional programs (especially for first-time buyers or qualifying borrowers).

- Examples of low-down-payment conventional options include programs tied to Fannie Mae and Freddie Mac guidelines.

- If you put less than 20% down, you’ll typically pay private mortgage insurance (PMI)more on that soon.

FHA loans (commonly 3.5% down, credit-score dependent)

- 3.5% down is widely cited as the minimum when you meet FHA credit-score thresholds.

- With lower credit scores, a 10% down requirement may apply (depending on lender rules and eligibility).

- FHA loans require mortgage insurance premiums (MIP), and MIP rules differ from conventional PMI.

VA loans (often 0% down for eligible borrowers)

- VA home loans are known for no down payment requirement for many eligible borrowers.

- VA loans also generally avoid monthly PMI, though borrowers may pay a VA funding fee (with exceptions in some cases).

USDA loans (often 0% down for eligible rural/suburban areas)

- The USDA Single Family Housing Guaranteed Loan Program can offer no money down for qualified buyers purchasing in eligible areas and meeting income requirements.

- These loans have their own fees/requirements (and not every lender offers them).

Jumbo loans (often 10%–20%+ down)

- Jumbo loans exceed conforming loan limits and often come with stricter underwriting.

- Many lenders require a larger down paymentcommonly 10% to 20% (sometimes more) plus additional cash reserves.

Why 20% down is famous (and when it’s worth chasing)

The 20% number became the celebrity of down payments for two main reasons:

PMI and risk.

1) PMI: the “less-than-20%” surcharge (for conventional loans)

On conventional mortgages, PMI is generally required when you put down less than 20%.

PMI protects the lendernot youif the loan defaults. The good news: PMI isn’t necessarily forever.

Homeowners can often request PMI cancellation once the loan balance is scheduled to reach about 80% of the home’s original value (assuming you meet requirements).

That means 20% down can buy you a simpler monthly payment: fewer moving parts, fewer fees, fewer “why is my payment higher than my friend’s?” moments.

2) A larger down payment can lower your interest rate (sometimes)

Not every lender prices the same way, but down payment size can influence risk-based pricing.

Higher down payments can sometimes help you qualify for better terms or avoid certain fees.

That said, the best rate depends on the whole picture: credit score, debt-to-income ratio, loan type, occupancy, and market rates.

3) More down means more equity cushion

A bigger down payment reduces your loan size and gives you a buffer if home prices dip.

That buffer can matter if you need to sell sooner than expected or refinance later.

How to choose a down payment: a practical framework

Instead of asking, “What’s the perfect down payment?” ask:

What’s the best down payment for my budget, my timeline, and my stress level?

Step 1: Determine your “cash-to-close” limit (not just down payment)

Your down payment is only one part of what you need upfront.

Closing costs commonly range from about 2% to 5% of the home purchase price (separate from your down payment), though the exact number depends on your loan, location, and transaction details.

Rule of thumb: before you pick a down payment number, estimate:

- Down payment

- Closing costs (lender fees, appraisal, title/escrow, prepaid items, etc.)

- Reserves (an emergency cushion so you’re not “house rich, cash poor”)

- Moving + immediate repairs (the home will not maintain itself out of gratitude)

Step 2: Compare monthly payments at 3%, 10%, and 20% down

Let’s use a simple example with a $400,000 home price.

(This is an illustrationtaxes, insurance, HOA, rates, and PMI vary widely.)

| Down Payment | Percent | Cash Down | Loan Amount | Mortgage Insurance? |

|---|---|---|---|---|

| Low down payment | 3% | $12,000 | $388,000 | Likely PMI (conventional) or MIP (FHA) |

| Moderate down payment | 10% | $40,000 | $360,000 | Often PMI (conventional); MIP rules differ for FHA |

| Classic “PMI-avoidance” down payment | 20% | $80,000 | $320,000 | Usually no PMI on conventional |

Notice what changes: the loan amount drops, and your monthly payment generally follows.

But the tradeoff is timesaving an extra $40,000–$68,000 can take years, and housing markets don’t always wait politely.

Step 3: Decide whether avoiding PMI is worth delaying your purchase

PMI can feel annoying (because it is), but it’s also a tool: it can let you buy sooner with less cash upfront.

The real question is whether PMI plus a higher loan amount still fits your monthly budget and your long-term plan.

If paying PMI means you can buy a home you can comfortably afford and start building equity sooner, it may be a reasonable cost.

If paying PMI pushes your payment into “ramen-budget” territory, it’s a red flag.

Loan-program reality check: what the minimum does (and doesn’t) mean

Conforming loan limits can affect your options

Conventional loans that meet conforming guidelines fall under FHFA loan limits, which are updated periodically.

If your loan amount goes above those limits in your county, you may be looking at jumbo financingwhere down payment and reserve requirements often increase.

FHA vs. conventional: mortgage insurance works differently

With conventional loans, PMI is often tied to putting less than 20% down and may be removable later.

With FHA loans, mortgage insurance (MIP) is generally required, and the duration/cost structure differs from conventional PMI.

That means “low down payment” doesn’t automatically mean “FHA is best”sometimes a 3% or 5% conventional option can be competitive depending on your credit and pricing.

0% down isn’t “free”it’s “different math”

VA and USDA loans can reduce the upfront barrier with 0% down, but you still need to plan for closing costs and eligibility requirements.

With VA loans, the funding fee may apply (though some borrowers are exempt), and lenders still evaluate credit and income.

With USDA, location and income eligibility are key, and not every property qualifies.

Down payment assistance: help exists, but it comes with rules

Down payment assistance (DPA) programs can be a game-changer, especially for first-time buyers or buyers with low-to-moderate incomes.

Many programs are offered through state and local housing finance agencies, cities, nonprofits, and sometimes lenders.

Assistance can show up as grants, forgivable loans, or low-interest second mortgages.

Important: every program has fine print. You may see requirements like:

- Income caps based on the area median income (AMI)

- Purchase price limits

- First-time homebuyer definitions (often “haven’t owned in 3 years,” but it varies)

- Homebuyer education courses

- Occupancy rules (usually must be your primary residence)

If you’re exploring DPA, ask your lender what’s available locally.

There are also tools and resources from major housing organizations that help match borrowers to DPA programs.

How much should you put down? Common scenarios with specific examples

Scenario A: First-time buyer with solid credit, limited cash

Typical strategy: 3%–5% down on a conforming conventional loan, plus a healthy emergency fund.

Why it can work: You keep more cash for closing costs, moving, and reserves. You may pay PMI, but PMI can sometimes be removed later once equity grows and requirements are met.

Watch-outs: PMI cost varies by credit profile and down payment. Also, sellers may prefer stronger offers in competitive marketsso you may need other strengths (strong preapproval, flexible closing timeline, larger earnest money).

Scenario B: Buyer with a smaller down payment and a “credit rebuild” story

Typical strategy: FHA with 3.5% down (if you qualify), possibly combined with down payment assistance.

Why it can work: FHA can be more flexible on credit and may open the door to homeownership sooner.

Watch-outs: FHA mortgage insurance rules differ from conventional PMI, and you’ll want to compare the full monthly cost (principal + interest + insurance + taxes + FHA insurance).

Scenario C: Eligible service member or veteran

Typical strategy: VA loan with 0% down (if eligible) and focus on keeping reserves.

Why it can work: No down payment requirement for many borrowers and typically no monthly PMI, which can keep payments more manageable.

Watch-outs: The VA funding fee may apply, and lenders may still require certain credit/income standards.

Scenario D: High-cost market buyer bumping into jumbo territory

Typical strategy: Plan for 10%–20%+ down and additional reserves; shop lenders aggressively.

Why it can work: Jumbo underwriting tends to reward strong financesbigger down payment, stronger credit, and documented assets.

Watch-outs: Jumbo requirements vary significantly by lender. Some scenarios may require 20%–25% down, especially for certain property types or second homes.

Saving for a down payment without hating your life

Down payment saving is mostly a game of consistency, not heroics. Tactics that commonly help:

- Automate the savings: Treat it like a bill you pay yourself.

- Use a separate account: Out of sight, out of impulse-buy range.

- Track “cash-to-close” monthly: Down payment + estimated closing costs + reserves. Watching the full number prevents unpleasant surprises.

- Audit big categories: Housing, cars, subscriptions, and “just grabbing coffee” (the sneakiest budget gremlin).

- Don’t drain your emergency fund: A home will test your cash buffer like it’s a sport.

Real-World Down Payment Experiences : What People Learn After the Paperwork

Ask a handful of recent homebuyers what they’d do differently, and you’ll hear a theme: the down payment is important, but it’s rarely the only surprise.

Many buyers begin with a single number in mind (“I’m doing 10%!”) and end up adjusting when the full cash-to-close picture becomes real.

One common experience is the “closing cost wake-up call.” Buyers save diligently for a down payment, then receive a Loan Estimate and realize they also need funds for title/escrow, lender fees, prepaid homeowners insurance, and initial escrow funding.

The reaction is often: “Wait… that’s in addition to my down payment?”

The best-prepared buyers are the ones who ran a few scenarios early3% down, 5% down, 10% downand asked a lender for ballpark closing costs in their area so they could budget for the complete upfront package.

Another common story is what you might call the “PMI tradeoff that wasn’t actually terrible.”

Some buyers go in thinking PMI is an automatic deal-breaker, but after comparing monthly payments, they realize PMI might be a manageable cost for a few yearsespecially if it helps them buy sooner while keeping a healthy emergency fund.

The buyers who feel best about this choice typically do two things: (1) they confirm how PMI could be removed later (and what requirements apply), and (2) they avoid maxing out their budget just because they technically qualify for a higher loan amount.

In other words, they use PMI as a bridge, not a permission slip to overspend.

Buyers who used down payment assistance often describe it as both a blessing and a paperwork marathon.

Assistance can reduce the cash you need upfront, but it can also add requirementslike education courses, extra documentation, or specific lender/program rules.

The smoothest experiences happen when buyers treat DPA like a “program with a process,” not a coupon. They ask early: Is this a grant or a loan? Is it forgivable? What triggers repayment? Does it affect the interest rate?

When those questions are answered upfront, the program feels like supportnot like a surprise pop quiz at closing.

In competitive markets, some buyers learn that down payment size can affect more than the mortgageit can affect the offer strategy.

A higher down payment may signal strength to sellers (even if it doesn’t always change appraisal risk), and some buyers choose to put more down simply to make their offer feel sturdier.

Others keep the down payment moderate but strengthen the offer in different ways: flexible closing dates, faster inspections, or clear proof of funds for closing costs and reserves.

The “experience-based” takeaway is that down payment is one lever among many, and you don’t have to pull only that lever to be competitive.

Finally, there’s the experience nearly everyone shares: once you own the home, you realize why people warned you not to spend every last dollar on the down payment.

A water heater can fail with comedic timing. A dishwasher can pick the first week to audition for a horror movie. A small repair can become a “while we’re at it” project.

Buyers who left themselves a cushion tend to sleep betterliterallybecause they can handle repairs without going into high-interest debt.

If you remember only one real-world lesson, make it this: a “smaller” down payment that preserves reserves can be smarter than a “bigger” down payment that leaves you financially fragile.

Conclusion: Pick a down payment you can live with (and still afford life)

You don’t need 20% down to buy a home, but you do need a plan.

Start with your cash-to-close budget, compare loan options, understand mortgage insurance, and protect your emergency fund like it’s the last slice of pizza.

For many first-time buyers, the sweet spot is often somewhere between “minimum possible” and “every dime I’ve ever seen.”

The best down payment is the one that gets you into a home you can truly affordtoday, next year, and when something inevitably breaks the moment you unpack.