Table of Contents >> Show >> Hide

- The Big Picture: Why Your Paycheck Feels Too Small

- How the System Quietly Shrinks Your Paycheck

- Why Your Pay Might Be Lower Than It “Should” Be

- Practical Ways to Raise What You Actually Take Home

- A Wealth of Common Sense Approach to Your Paycheck

- Real-World Experiences: When the Paycheck Finally Makes Sense

- Conclusion: Your Paycheck Deserves Your Attention

If you’ve ever opened your online banking app on payday and thought, “Wait… that’s it?” you’re not alone. Many Americans feel like their paycheck is mysteriously shrinking, even when their salary looks decent on paper. Between confusing deductions, rising prices, and a compensation system that often hides the real numbers, your take-home pay can easily end up lower than it should be.

In the spirit of A Wealth of Common Sense, let’s strip away the jargon and look at what’s really going on with your paycheck. We’ll walk through why your take-home pay feels too small, what’s quietly nibbling away at your income, and how to use some very practical common sense to keep more of what you earn.

The Big Picture: Why Your Paycheck Feels Too Small

Before we zoom in on your personal pay stub, it helps to zoom out and look at the bigger forces that shape your income. Your paycheck doesn’t exist in a vacuum; it’s part of the broader economy, labor market, and cost-of-living trends.

Wages vs. Inflation: The Silent Tug-of-War

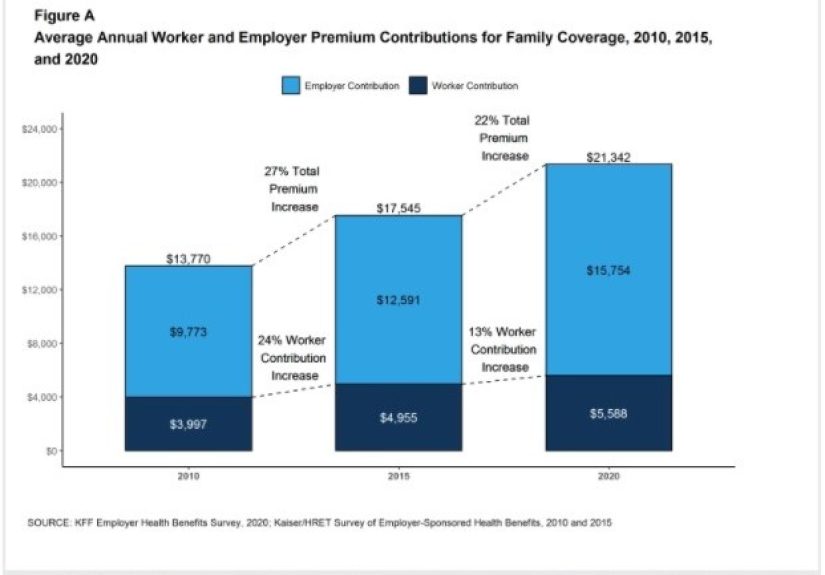

One major reason your paycheck feels lower than it should is inflation. Even when your pay goes up a little, rising prices for housing, groceries, healthcare, and childcare can erase those gains. Over the last several years, periods of high inflation have eaten into real wage growth, leaving many households feeling stuck or even behind, despite nominal raises.

In some recent years, average wages have struggled to consistently outpace inflation. That means your dollar buys less than it used to, so the same paycheck simply doesn’t stretch as far. You’re not imagining it: your money is being spread thinner across higher bills.

The Productivity–Pay Gap

There’s another long-running issue: productivity has grown faster than typical workers’ pay. In other words, workers are producing more value per hour, but that extra value hasn’t fully flowed into their paychecks. A chunk of it has gone elsewhereto profits, executive compensation, and returns to capital.

From a worker’s perspective, that’s like running faster on the treadmill while the speed of the paycheck belt barely increases. Over time, that gap compounds, and it can leave you feeling like you’re doing everything “right” and still not getting ahead.

The Cost-of-Living Squeeze

Even if your wages have technically risen, the cost of housing, higher education, and healthcare has risen faster than many other prices. That’s the painful combination: modest wage growth plus big-ticket essentials getting more expensive. When your rent jumps by 8% but your raise is 3%, it doesn’t feel like progress.

So yes, the system itself makes it easy for your paycheck to feel lower than it should be. But the system isn’t the whole storyyour pay stub is hiding a lot of the details, too.

How the System Quietly Shrinks Your Paycheck

Your “salary” and your “paycheck” are not the same thing. Your salary is the headline number; your paycheck is the reality. The difference between them is made up of taxes, benefits, and other deductions that can take a big bite out of your income before it ever hits your bank account.

Gross Pay vs. Net Pay: The First Reality Check

Start with two key terms:

- Gross pay: What you earn before any taxes or deductions.

- Net pay (or take-home pay): What’s left after all the deductions. This is the number that actually matters to your day-to-day life.

Many job offers are presented in terms of annual gross salary: “You’ll make $70,000 a year.” That sounds gooduntil your first paycheck arrives and you discover how much disappears into taxes and benefits. If you’re not looking closely, it’s easy to feel like something is “wrong” with your paycheck, when part of the disconnect is just the difference between gross and net pay.

Taxes: Necessary, but Still a Buzzkill

Taxes are the most obvious reason your paycheck is lower than your salary. In the United States, paycheck deductions typically include:

- Federal income tax

- State and sometimes local income tax (depending on where you live)

- Social Security and Medicare payroll taxes

- Additional withholdings if you’ve asked for them on your W-4

Your tax withholding is based on your income level, filing status, and the information you provided your employer. If your W-4 is set up conservatively, your employer may be withholding more than is strictly necessary, which means less cash each paycheck (and possibly a refund at tax time).

Big picture: taxes are not a mistakethey’re part of the system. But if you haven’t updated your withholding in years, you might be giving Uncle Sam an interest-free loan while feeling broke every other Friday.

Benefits and Deductions: Valuable but Invisible

Next, benefits. These can be genuinely valuable, but they also reduce your take-home pay. Common paycheck deductions include:

- Health, dental, and vision insurance premiums

- Health savings account (HSA) or flexible spending account (FSA) contributions

- 401(k) or 403(b) retirement contributions

- Life or disability insurance

- Union dues or other voluntary deductions

Individually, these may not seem like much. Together, they can easily cut your net pay by 10–25% or more. From a total compensation perspective, these benefits may be worth it. From a short-term “I need to pay rent” perspective, they can make your paycheck feel painfully thin.

Other Surprises: Garnishments, Fees, and Errors

Sometimes, paychecks are lower for reasons that are fixableor at least negotiable. These can include:

- Wage garnishments for child support, tax debt, or other legal obligations

- Repayments of signing bonuses or relocation assistance if you left a job early

- Administrative errors in overtime calculation, hours worked, or pay rates

This is why reading your pay stub regularly is a money habit with an excellent return on time invested. Mistakes do happen, and if you don’t check, you’re the one quietly funding them.

Why Your Pay Might Be Lower Than It “Should” Be

So far, we’ve talked about why your paycheck is smaller than your salary. But there’s a deeper question: is the salary itself lower than it should be?

Wage Stagnation and Inequality

Over decades, wage growth for many workersespecially in the middle and lower ends of the income distributionhas lagged behind economic growth. While top earners and certain high-demand fields saw big gains, a lot of people in “regular” jobs watched their wages barely move after adjusting for inflation.

The result is a feeling that you’re doing more work for not much more money. In many households, both adults work, side hustles are common, and yet the margin between income and expenses remains razor thin. Living paycheck to paycheck has become normal, not exceptional.

Weak Bargaining Power and Pay Transparency Problems

Your paycheck also depends heavily on how much leverage you have. Factors that can weaken your bargaining power include:

- Limited job options in your area or industry

- Lack of union representation

- Not knowing what others in similar roles are paid

- Discomfort with negotiating offers or raises

Historically, many employers discouraged talking about pay. While that’s changing in some placesthanks to pay transparency laws and online salary datathere’s still a lot of “I guess this is normal?” going on. If you don’t know the market rate for your work, it’s hard to know whether your paycheck is fair or quietly discounted.

Confusing “Total Compensation” Packages

Another issue is how pay is presented. Employers increasingly talk about “total compensation,” which combines your base salary with:

- Bonuses or commissions

- Stock options or equity

- Employer retirement plan contributions

- Paid time off and holidays

- Insurance and wellness benefits

This can be greatif the total package is truly generous. But it can also be a way to make a modest salary sound more impressive. For example, a company might emphasize the value of its health plan while your actual monthly premiums and high deductibles leave you feeling strapped.

If you’re comparing jobs, focusing on salary alone can mislead you. If you’re trying to pay your bills, focusing on total compensation can mislead you in a different way. The real question is, “How much cash lands in my checking account each month, and what am I realistically getting in return for the rest?”

Practical Ways to Raise What You Actually Take Home

Now for the hopeful part. You can’t fix the global economy, but you can use a little common sense to make your paycheck work harderand, in some cases, make it bigger.

1. Audit Your Pay Stub Like a Pro

Start by pulling up your latest pay stub and going line by line. For each deduction, ask:

- Do I understand what this is?

- Is the amount correct?

- Is this still the right choice for my situation?

Look for:

- Incorrect tax withholding based on your filing status

- Benefits you no longer use but still pay for

- Retirement contributions that are higher or lower than you realized

- Hours, overtime, or bonuses that seem off

If something doesn’t make sense, ask your HR or payroll department to walk through it with you. They may not be thrilled, but you’re the one living with the consequences.

2. Revisit Your Tax Withholding

If you consistently get a big tax refund, that’s a sign your paycheck might be lower than it needs to be. Adjusting your withholdingusing the IRS calculator and updated W-4 instructionscan bring more money into each paycheck while keeping you on the right side of the tax bill.

Just don’t swing too far and end up owing a painful amount next April. The goal is balance: enough withheld to avoid penalties, not so much that you’re starving your current cash flow.

3. Align Your Benefits with Your Real Life

Benefits are powerful, but they should match your reality:

- If you’re paying for the most expensive health plan but rarely use medical care, a cheaper option might free up cash.

- If you have high-interest debt, temporarily lowering retirement contributions (while at least capturing the employer match) might make sense until that debt is under control.

- If you signed up for every optional add-on during onboarding, it may be time for a cleanup.

Your benefits should protect and support you, not quietly strangle your paycheck.

4. Know Your Market Value and Negotiate

Use salary comparison tools, job postings with pay ranges, and professional networks to understand what your role is worth in your area or industry. If you discover you’re significantly underpaid:

- Document your accomplishments and added responsibilities.

- Schedule a conversation with your manager focused on your value, not your bills.

- Be ready to ask for a specific, reasonable raise based on market data.

Sometimes the answer will still be “no.” In that case, at least you have a data-backed reason to consider applying elsewhere.

5. Think Beyond the Single Paycheck

Finally, one of the most powerful ways to make your paycheck feel less fragile is to build income streams beyond your primary job. This doesn’t have to mean grinding yourself into burnout. It can mean:

- Freelance work in your existing field

- Part-time consulting or tutoring

- Building a small side business

- Upskilling into a higher-paying role or industry over time

From a common-sense perspective, relying on one paycheck in a world of rising costs and job uncertainty is risky. Diversifying your incomeeven modestlycan give you more options and bargaining power.

A Wealth of Common Sense Approach to Your Paycheck

At its core, a “wealth of common sense” approach to money is about clarity and practicality. When it comes to your paycheck, that means:

- Understanding the difference between your salary and your take-home pay

- Knowing where every dollar of your paycheck goes and why

- Recognizing when your compensation doesn’t match your value

- Taking strategic steps to improve both your income and your financial resilience

Your paycheck might be lower than it should be for reasons outside your controlbut that doesn’t mean you’re powerless. The combination of information, negotiation, and thoughtful choices can move you closer to what you deserve.

Real-World Experiences: When the Paycheck Finally Makes Sense

To bring all of this down to earth, let’s look at a few composite examples based on common situations. Names and details are generalized for illustration, but the themes will probably feel familiar.

Case 1: The “Decent Salary, Tiny Paycheck” Mystery

Jordan landed a job at $80,000 a year and thought they were set. But their biweekly paycheck looked suspiciously like their old $60,000 job. After a little investigation, here’s what they discovered:

- They had chosen the most expensive health plan out of fear of “what if,” even though they rarely went to the doctor.

- They were contributing 12% of pay to a retirement plan plus a separate emergency savings deduction their employer offered.

- Their W-4 assumed no other income and was set to withhold conservatively, leading to a large tax refund every year.

On paper, Jordan’s total compensation was excellent. In practice, their everyday cash flow was tight. After talking to HR and using updated tax tools, they adjusted their health plan, brought retirement contributions down to a still-respectable level (while capturing the employer match), and corrected their withholding.

The result? Their paycheck increased by several hundred dollars per pay periodwithout changing their salary at all. Long-term goals stayed on track; short-term life got less stressful.

Case 2: Underpaid and Under-Asked

Alex had been in the same role for five years. They kept getting “cost-of-living” raises, but nothing more. A friend suggested checking salary data online. Alex discovered that people in similar roles, at similar-sized companies in the same region, were making 10–20% more.

Instead of storming into their manager’s office, Alex gathered:

- Concrete examples of projects where they had saved the company money or improved processes

- Market pay data from multiple sources

- A clear, specific request for an adjustment to bring their pay in line with the market

The first conversation led to “We’ll have to look into this,” which is corporate for “No immediate promises.” But three months later, when budget reviews came around, Alex’s pay was adjusted upwardnot all the way, but enough to close most of the gap. Without doing the research and asking, that money would have stayed on the table.

Case 3: The Hidden Cost of “Great Benefits”

Sam loved telling friends about their job’s “amazing benefits.” On the surface, it looked like a dream: generous insurance, wellness programs, retirement matches, even gym discounts. Yet Sam constantly felt broke.

When they sat down and calculated the actual monthly cash impact, they realized:

- They were paying for family-level coverage even though they were single.

- They had signed up for multiple voluntary insurance products they didn’t really need.

- They were overcontributing to a high-deductible health plan without using the associated HSA strategically.

By tailoring the benefits to their actual liferather than the idealized brochure versionSam freed up several hundred dollars per month while keeping the protections that really mattered. Their paycheck finally started to feel like it matched their effort at work.

What These Stories Have in Common

In each of these situations, the person didn’t magically double their income overnight. What they did was:

- Get clarity on where their money was going

- Use available information about taxes, benefits, and market pay

- Make informed adjustments instead of assuming “I guess this is just how it is”

That’s the core of a wealth-of-common-sense approach: no gimmicks, no secretsjust understanding the system well enough to stop leaving money on the table and start making choices on purpose.

Conclusion: Your Paycheck Deserves Your Attention

Your paycheck may be lower than it should be because of big economic trends, employer policies, confusing benefit structures, or simple inertia. You can’t control everything, but you can:

- Read and understand your pay stub

- Align your benefits with your real needs

- Optimize your tax withholding

- Know your market value and negotiate when appropriate

- Build additional income streams over time

Money may be complicated, but your strategy doesn’t have to be. A little clarity, some basic math, and a willingness to ask questions can go a long way toward making sure your paycheck looks more like what it should beand less like a disappointing surprise twice a month.

meta_title: Why Your Paycheck Is Lower Than It Should Be

meta_description: Learn the real reasons your paycheck feels too small and practical steps to raise your take-home pay using common-sense money strategies.

sapo: Do you ever look at your paycheck and wonder where the rest of your money went? You’re not imagining it. Between taxes, confusing benefits, wage stagnation, and a rising cost of living, your take-home pay can easily end up much lower than it should be. In this in-depth, plain-English guide inspired by a “wealth of common sense” mindset, you’ll learn how your paycheck is really calculated, why it feels smaller than your salary, and what you can dostarting this monthto keep more of what you earn without abandoning your long-term goals.

keywords: why your paycheck is lower than it should be, take-home pay, net vs gross pay, total compensation, wage stagnation, paycheck to paycheck, how to increase your paycheck